SMARTEST FWA DETECTION TOOL FOR INSURERS

SMARTEST FWA DETECTION TOOL FOR INSURERS

Hoverr goes beyond static rules to detect complex, evolving fraud patterns in real time using adaptive AI that continuously learns from claims data.

Hoverr goes beyond static rules to detect complex, evolving fraud patterns in real time using adaptive AI that continuously learns from claims data.

Compliance ready

Compliance ready

Compliance ready

Built to meet regulatory, audit, and governance requirements.

Built to meet regulatory, audit, and governance requirements.

Built to meet regulatory, audit, and governance requirements.

24/7 customer support

24/7 customer support

24/7 customer support

Always-on support to keep your claims operations running smoothly.

Always-on support to keep your claims operations running smoothly.

Always-on support to keep your claims operations running smoothly.

Reliable

Reliable

Reliable

Consistent performance you can trust across high-volume claim workloads.

Consistent performance you can trust across high-volume claim workloads.

Consistent performance you can trust across high-volume claim workloads.

How it works. It's simple!

How it works. It's simple!

How it works. It's simple!

1

1

Process claims

Process claims

Process claims

Any claim, any format. Hoverr handles claim documents of all kind.

Any claim, any format. Hoverr handles claim documents of all kind.

Any claim, any format. Hoverr handles claim documents of all kind.

2

2

Categorization

Categorization

Categorization

Hoverr organizes claims into subcategorizations for speed and efficiency.

Hoverr organizes claims into subcategorizations for speed and efficiency.

3

3

FWA detection

FWA detection

FWA detection

Hoverr scans claims using intelligent AI processes for 3x the traditional accuracy.

4

4

Formating

Formating

Formating

Hoverr formats output as desired and feeds directly into legacy claim systems.

Detect complex FWA typologies

Detect complex FWA typologies

Detect complex FWA typologies

Subtle upcoding

Routine cases billed as complex treatments.

Metadata manipulation

Minor edits or forged notes that seem legit.

Phantom procedure

Small, unnecessary add-ons hide inside legitimate claims

Subtle upcoding

Routine cases billed as complex treatments.

Metadata manipulation

Minor edits or forged notes that seem legit.

Phantom procedure

Small, unnecessary add-ons hide inside legitimate claims

Subtle upcoding

Routine cases billed as complex treatments.

Metadata manipulation

Minor edits or forged notes that seem legit.

Phantom procedure

Small, unnecessary add-ons hide inside legitimate claims

Subtle upcoding

Routine cases billed as complex treatments.

Review claims in an instance

Review claims in an instance

Review claims in an instance

Under 30s

Focus on high value investigations

Focus on high value investigations

Remove low-risk claims from manual review, freeing investigators to work on complex, high-impact cases.

Remove low-risk claims from manual review, freeing investigators to work on complex, high-impact cases.

Make better decisions, earlier

Make better decisions, earlier

Surface meaningful risk signals sooner, enabling earlier intervention and preventing costly downstream losses.

Surface meaningful risk signals sooner, enabling earlier intervention and preventing costly downstream losses.

Analyze Key Documents

Analyze Key Documents

Analyze Key Documents

Works with all kinds of health insurance documents

Works with all kinds of health insurance documents

Initial guarantee letter

Initial guarantee letter

Analyzes coverage terms, limits, and conditions to identify early risk signals before treatment begins.

Analyzes coverage terms, limits, and conditions to identify early risk signals before treatment begins.

Line by line analysis

Final guarantee letter

Final guarantee letter

Reviews final approvals and changes to detect inconsistencies between approved coverage and billed amounts.

Reviews final approvals and changes to detect inconsistencies between approved coverage and billed amounts.

Approval change detection

Reimbursement

Reimbursement

Breaks down submitted claims line by line to flag anomalies, duplicates, and unsupported charges.

Breaks down submitted claims line by line to flag anomalies, duplicates, and unsupported charges.

Anomaly detection

Top ups

Top ups

Examines additional charges against prior approvals to surface unjustified increases and late-stage cost inflation.

Examines additional charges against prior approvals to surface unjustified increases and late-stage cost inflation.

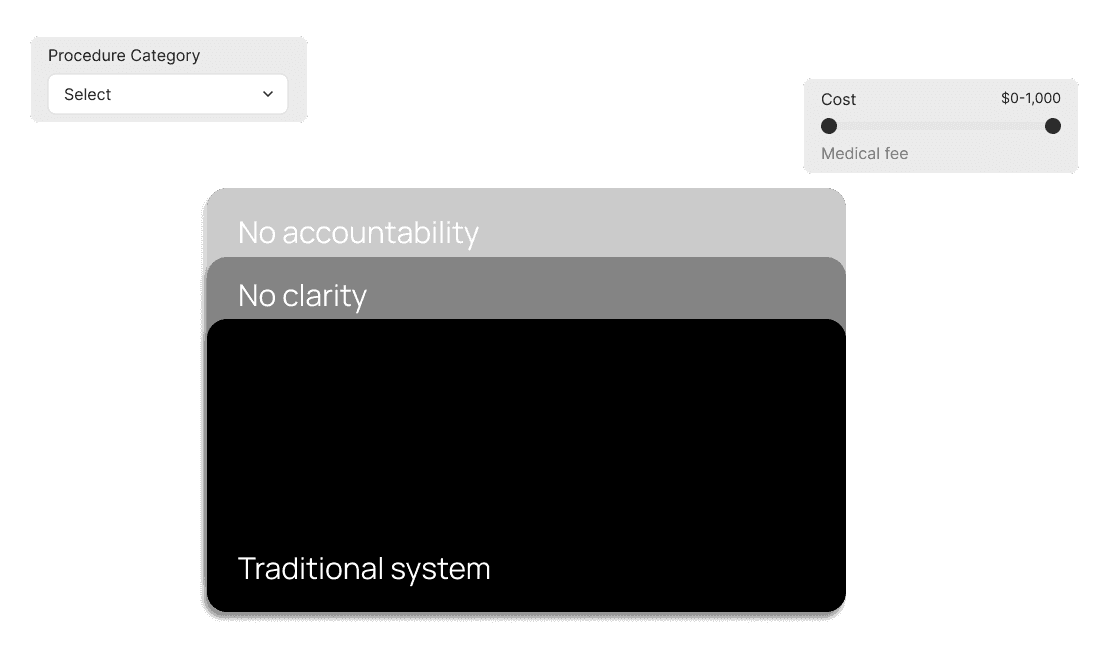

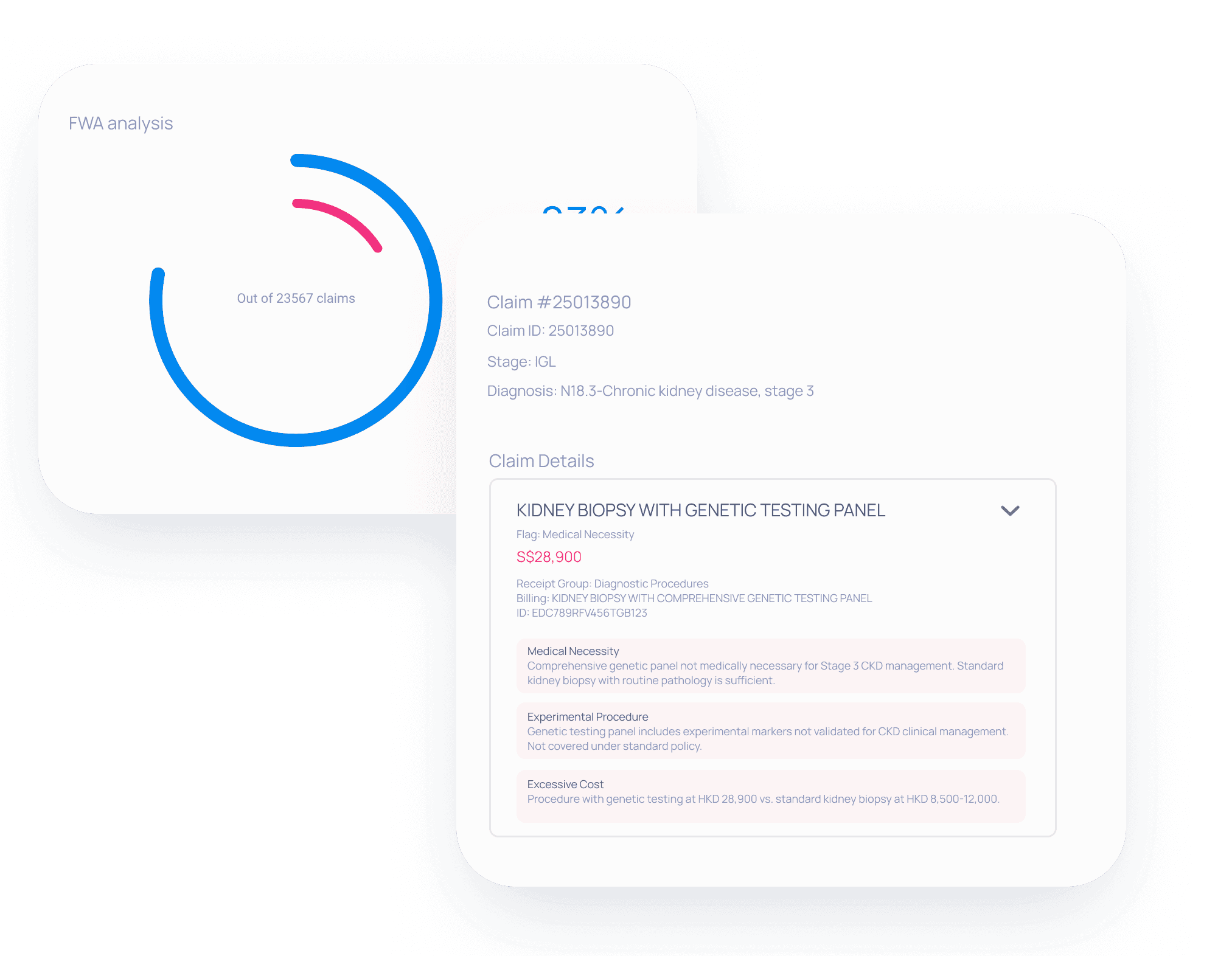

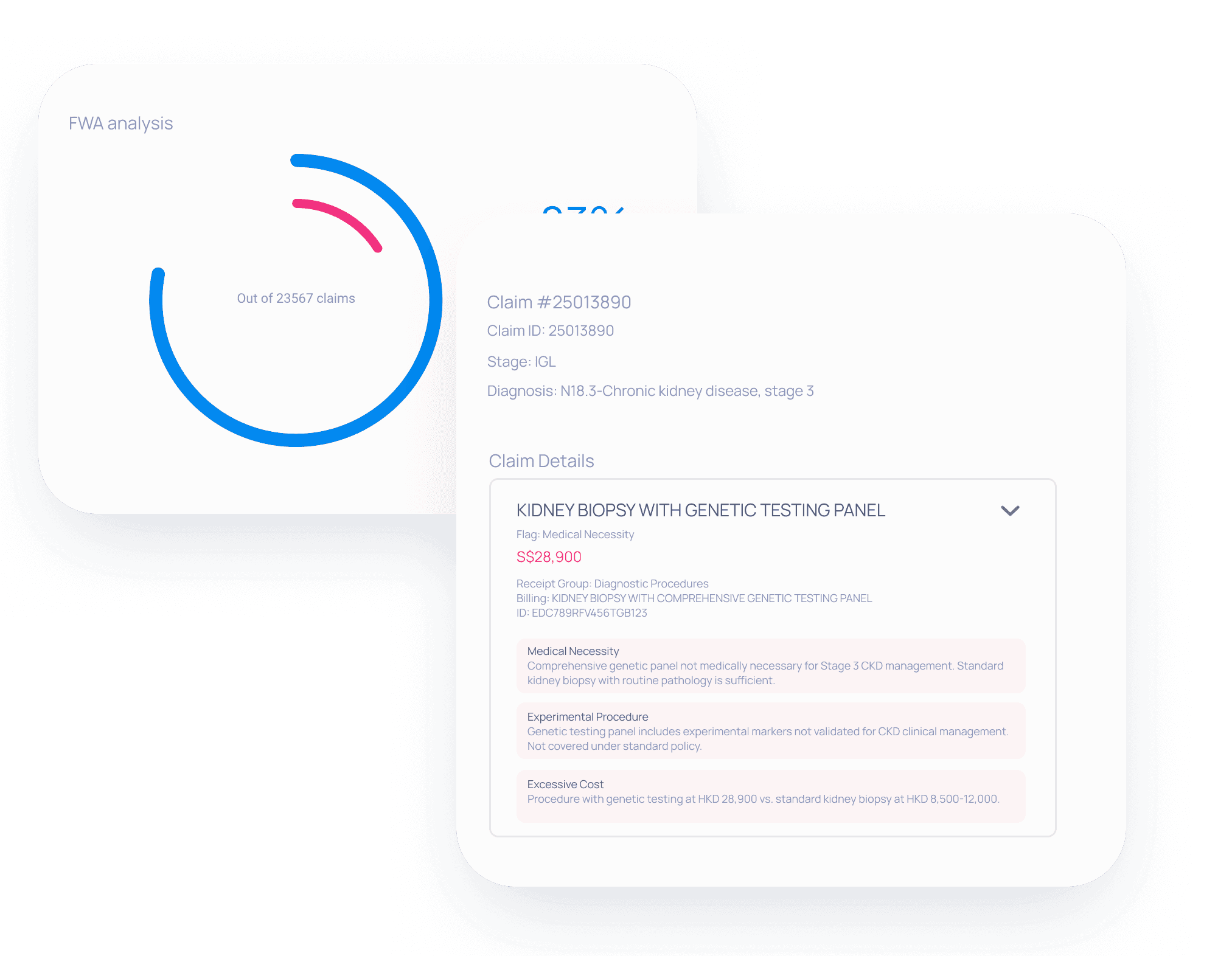

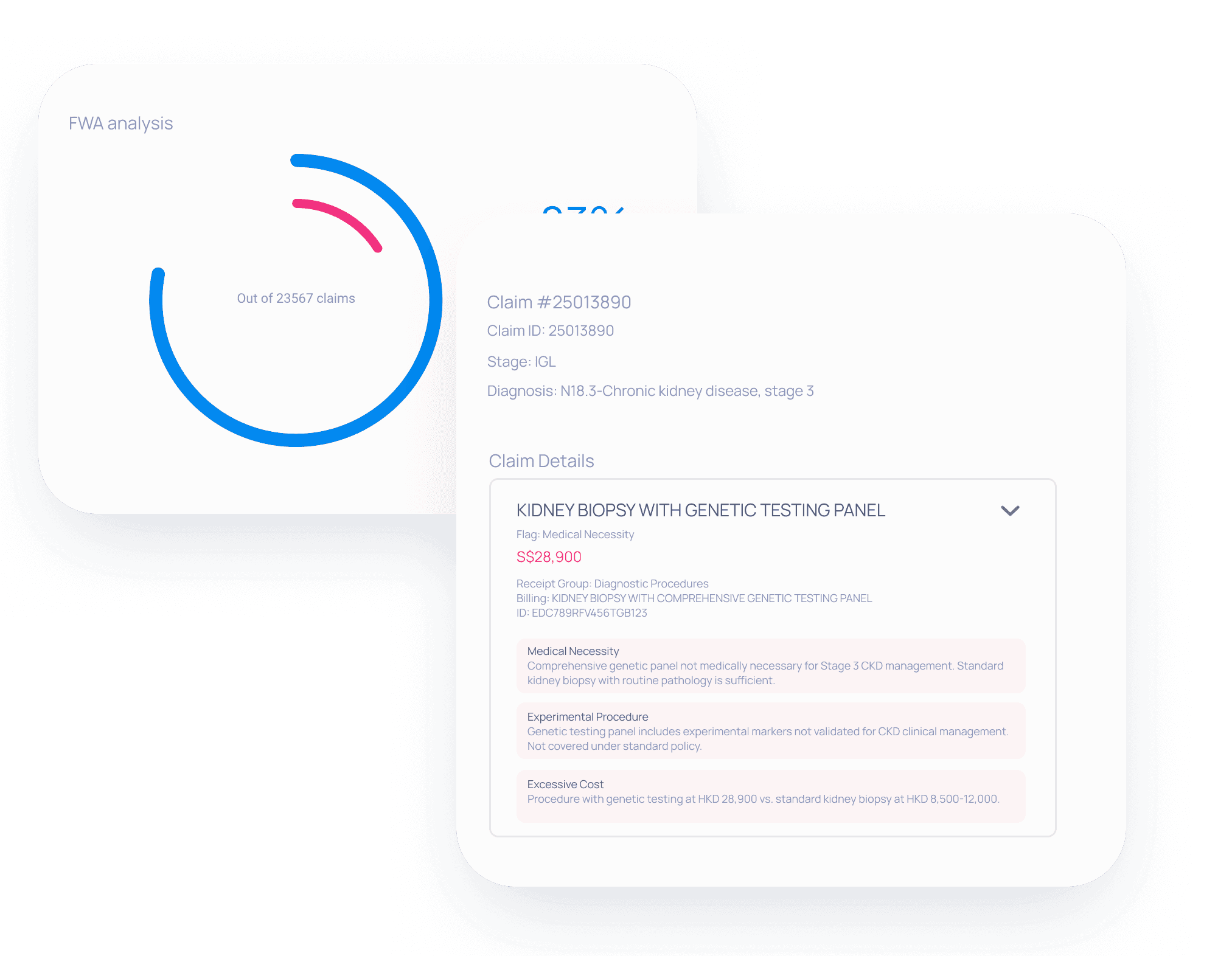

TRANSPARENT AI

Why transparency matters

In high-stakes claims decisions, unexplained AI creates risk. Transparency ensures decisions can be trusted, justified, and audited.

Legacy systems are black boxes

Hoverr is transparent by design

Hoverr is transparent by design, surfacing clear reasoning behind every risk signal. Teams always know what triggered a flag and why it matters.

Hoverr AI provides detailed explanations

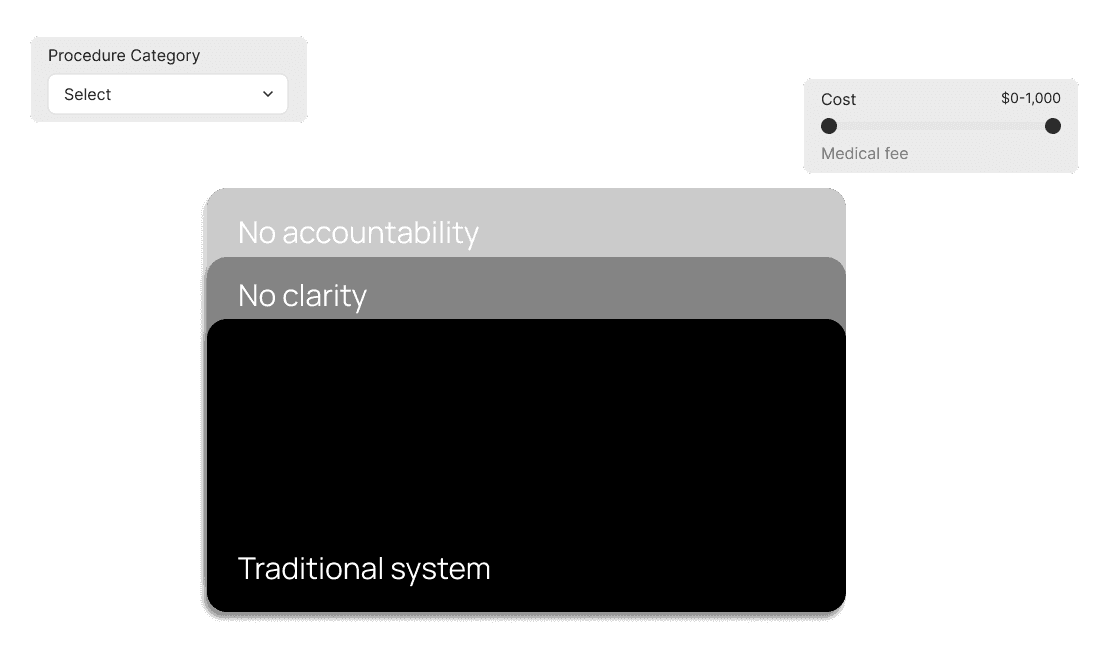

TRANSPARENT AI

Why transparency matters

In high-stakes claims decisions, unexplained AI creates risk. Transparency ensures decisions can be trusted, justified, and audited.

Legacy systems are black boxes

Hoverr is transparent by design

Hoverr is transparent by design, surfacing clear reasoning behind every risk signal. Teams always know what triggered a flag and why it matters.

Hoverr AI provides detailed explanations

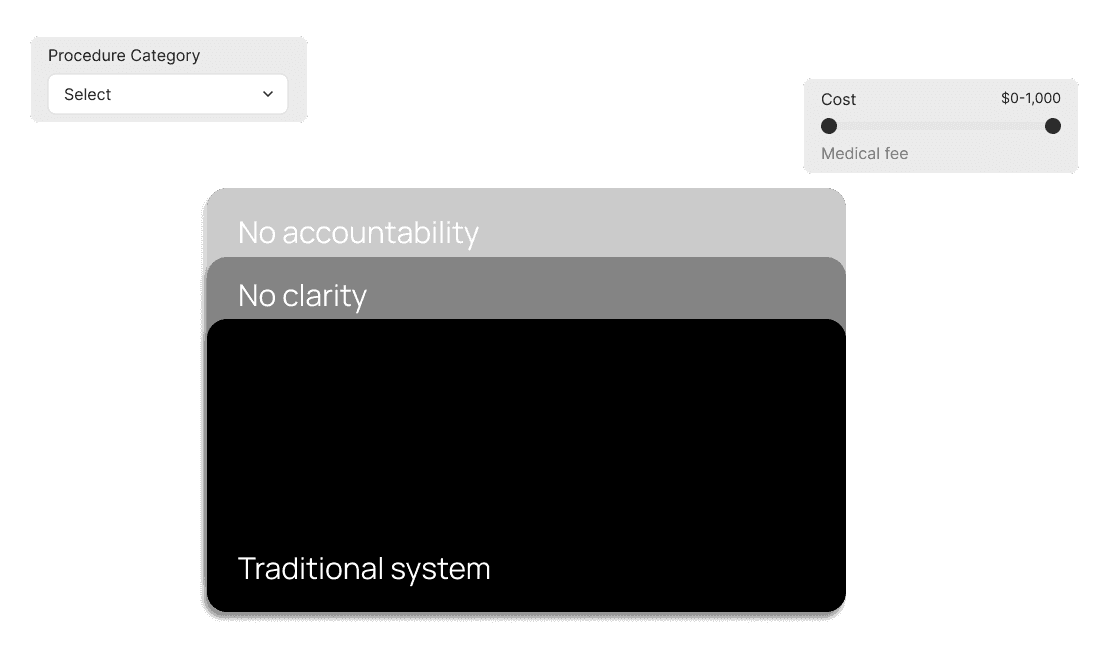

TRANSPARENT AI

Why transparency matters

In high-stakes claims decisions, unexplained AI creates risk. Transparency ensures decisions can be trusted, justified, and audited.

Legacy systems are black boxes

Hoverr is transparent by design

Hoverr is transparent by design, surfacing clear reasoning behind every risk signal. Teams always know what triggered a flag and why it matters.

Hoverr AI provides detailed explanations

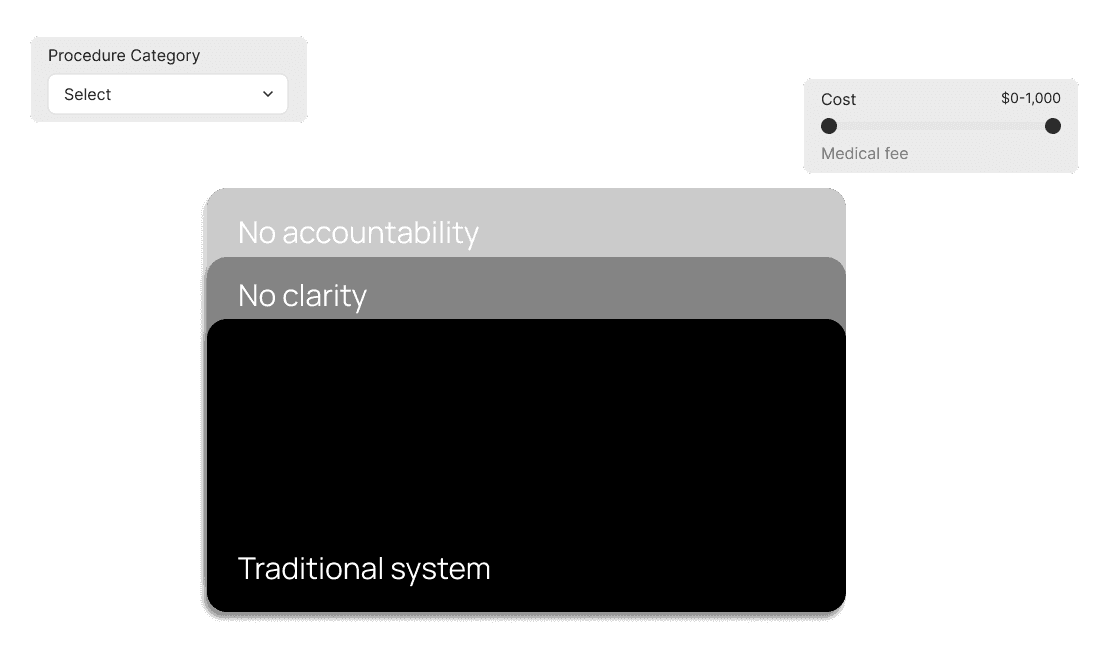

TRANSPARENT AI

Why transparency matters

In high-stakes claims decisions, unexplained AI creates risk. Transparency ensures decisions can be trusted, justified, and audited.

Legacy systems are black boxes

Hoverr is transparent by design

Hoverr is transparent by design, surfacing clear reasoning behind every risk signal. Teams always know what triggered a flag and why it matters.

Hoverr AI provides detailed explanations

Get detailed claim breakdown

Get detailed claim breakdown

Get detailed claim breakdown

Line by line analysis

Pinpoint risk with full context

Pinpoint risk with full context

Break claims down to individual line items, highlighting exactly where anomalies and inconsistencies occur.

Break claims down to individual line items, highlighting exactly where anomalies and inconsistencies occur.

Strengthen expert review and challenges

Strengthen expert review and challenges

Equip investigators with clear reasoning and evidence to confidently question providers, vendors, or internal decisions.

Equip investigators with clear reasoning and evidence to confidently question providers, vendors, or internal decisions.

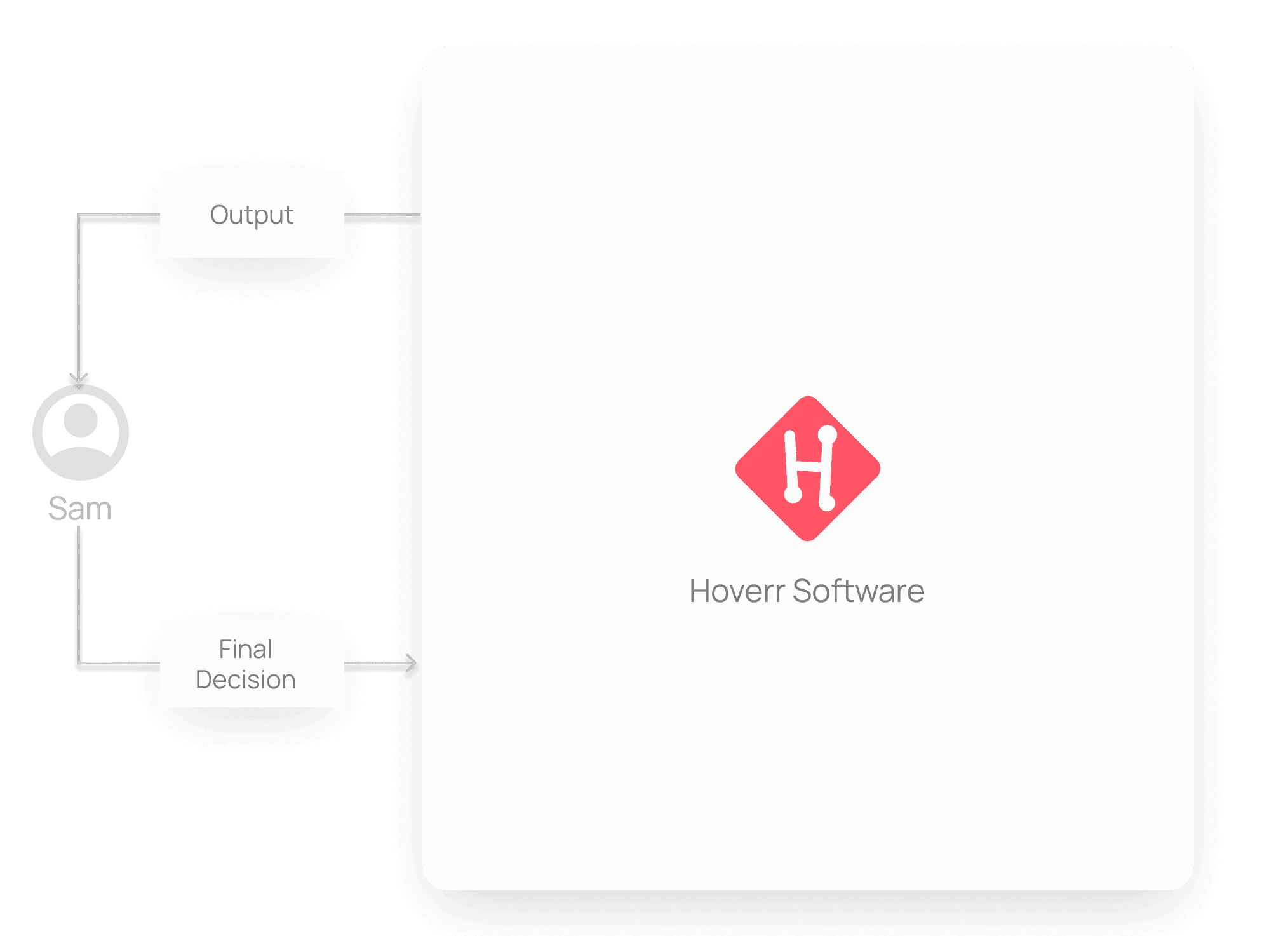

Human-in-the-loop

Human-in-the-loop

Human-in-the-loop

Full control

Decisions stay with your team

Decisions stay with your team

AI supports investigations, while final judgment and approvals remain firmly in human hands.

AI supports investigations, while final judgment and approvals remain firmly in human hands.

Built for compliance and auditability

Built for compliance and auditability

Ensure transparent, explainable decisions that stand up to regulatory scrutiny and internal audits.

Ensure transparent, explainable decisions that stand up to regulatory scrutiny and internal audits.

START DETECTING FWA WITH AI AGENTS

START DETECTING FWA WITH AI AGENTS

START DETECTING FWA WITH AI AGENTS